. : About me : .

Name::Trade Monkey

From::Middlebury, Connecticut, United States

Email Me!

View my profile

. : Recent Posts : .

Foreign Stocks Are In, and So Is Indexing

The Avuncular State

Greenspan predicts US governance revamp

Thorns in the Foliage

Risk and Commodity Futures

Hiring the Next Generation of Quants

The Single Market is Near!!

The Yen Also Rises

Imports From China Aren't Pricier -- Yet

Further evidence that the Fed may be done tightening:

. : Archives : .

February 2006

March 2006

April 2006

May 2006

June 2006

. : Tools : .

. : Fin/Econ Links : .

. : Misc Links : .

Atlas Shrugs

Belmont Club

Cato Institute

Foreign Dispatches

Instapundit

Kim Du Toit

MIT OpenCourseware

Oxblog

Protein Wisdom

Samizdata

Templates By Caz

TCS Daily

Truth on the Market

Volokh Conspiracy

**View my Wish List**

. : Credits : .

Template By Caz

Powered by: Blogger

Thursday, April 20, 2006

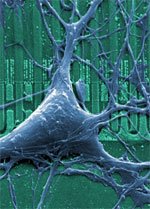

Neuro-economics From Tyler Cowen:

From Tyler Cowen:Not all of neuro-economics uses brain scans. Andrew W. Lo, a professor at the Sloan School of Management at the Massachusetts Institute of Technology, applied polygraph-like techniques to securities traders to show that anxiety and fear affect market behavior. Measuring eye movements, which is easy and cheap, helps the researcher ascertain what is on a subject's mind. Other researchers have opened up monkey skulls to measure individual neurons; monkey neurons fire in proportion to the amount and probability of rewards. But do most economists care? Are phrases like "nucleus accumbens" — referring to a subcortical nucleus of the brain associated with reward — welcome in a profession caught up in interest rates and money supply? Skeptics question whether neuro-economics explains real-world phenomena...

The next step? Perhaps neuro-economics should turn its attention to political economy. Do people use the same part of their brains to vote as to trade? Is voting governed by fear, disgust or perhaps the desire to gain something new and exciting?

Doing experiments on monkeys to assess traders ability?...why wasn't I invited?

In this experiment, I think the test subjects and the experimental subjects are more positively correlated than is normal ;)