Name::Trade Monkey

From::Middlebury, Connecticut, United States

Email Me!

View my profile

Can Managed Alpha Returns be Replicated?

Not With a Bang But a Whimper

The Trader is Dead, Long Live the Trader!

Want to be a Trade Monkey??

Fed Chief Wary of Regulating Hedge Funds

Lack of Posting

Headline of the Day

Power Law in FX Trading

How Not to Respond to High Gas Prices

VC Firms Bet on Clean Energy Deals

February 2006

March 2006

April 2006

May 2006

June 2006

Atlas Shrugs

Belmont Club

Cato Institute

Foreign Dispatches

Instapundit

Kim Du Toit

MIT OpenCourseware

Oxblog

Protein Wisdom

Samizdata

Templates By Caz

TCS Daily

Truth on the Market

Volokh Conspiracy

**View my Wish List**

Template By Caz

Powered by: Blogger

Thursday, April 27, 2006

How Not to Respond to High Gas Prices

Here is an excelent analysis, from Greg Mankiw's blog, of the bipartisan efforts to respond to the high gas prices:

Reuters reports:

Senate Republicans unveiled a proposal on Thursday to soften the blow of rapidly rising gasoline prices by giving taxpayers a $100 check and suspending a retail fuel tax....The proposal was similar to a Democratic measure first proposed by Senate Minority Leader Harry Reid of Nevada.

One might be tempted to applaud this sudden rush of bipartisanship. But let's first consider the economics of the proposal. I can see four drawbacks.

1. The economy is at or near full employment, and the Fed is raising interest rates to prevent the economy from overheating. Any stimulus to consumer spending would likely cause the Fed to increase interest rates to higher levels than it otherwise would have. The end result would be more consumption and less investment.

2. A lump-sum tax rebate has no supply-side incentive effects. Indeed, the history of such proposals is that the payments often phase-out as income rises. If so, this would be an increase in the effective marginal tax rate, which has adverse supply-side effects.

3. The federal budget is already on an unsustainable path. From the standpoint of the government budget constraint, this is a step in the wrong direction.

4. If gasoline taxes are suspended whenever prices go up, then consumers are partly insulated from price increases, making the effective demand curve for oil products less elastic. To the extent that prices are set by a supplier with market power (OPEC), a less elastic demand curve means higher prices.

Fortunately, the Senate proposal is a bit better than it might at first appear because:

To pay for the lost revenues, [Senator] Thune said, the legislation "would suspend a number of tax credits and royalty waivers received by oil corporations."

I don't know enough of the details to say whether these "tax credit and royalty waivers" should be suspended. But it seems that these policies should be judged on their own merits. The evaluation of these provisions need not be coupled with a lump-sum tax rebate and lower gasoline taxes, which are hard to defend on economic grounds.

Minus the "tax credit and royalty waivers" much of the mechanisms being discussed in Washington- such as excess profit taxes- have been tried in the 70's. If memory serves me correctly, the result was an further reduction of refinery capacity that only exaspirated the problem.

Wednesday, April 26, 2006

VC Firms Bet on Clean Energy Deals Good news...fuel prices have skyrocketed!

Good news...fuel prices have skyrocketed!While politicians fetter over what form of market manipulation is the best tool in lowering fuel prices, the private sector is already moving fast towards a long-term resolution.

From CNNMoney.com, via Finance Professor:

"Venture capital investors are flocking to clean energy technologies, a market expected to grow to $167 billion worldwide in the next decade, but some in the sector worry about too much money chasing too few deals.

Venture capitalists have been pumping increasing amounts of money into so-called clean energy technologies, ranging from solar power to alternative fuels and battery solutions. Venture capital funds invested $917 million in U.S.-based firms in the sector last year, up 22 percent from the previous year, according to Nth Power, a venture capital fund that focuses on energy technologies."

This month's Business 2.0 (sorry, can't find the link) has a great article on Silicon Valley start-ups that are poised to revolutionize the auto industry through the developement of electric engine technology. The end result of which will probably be an early buyout and technological integration from Detriot.

I expect rapid advancement in energy technology to come very soon rather than later. Of course expect much noise from Washington in the interim.

Tuesday, April 25, 2006

Alternative-Fuel-O-Rama:Popular Mechanics crunches the numbers on various alt-energy mechanisms.

Monday, April 24, 2006

Regulatory Arbitrage in Exchanges I posted about comments made by former Fed Chairman, Alan Greenspan regarding his "alarm" at the negative impact Sarbanes-Oxley have had on the US capital markets. Here is another take on the same subject from the Economist:

I posted about comments made by former Fed Chairman, Alan Greenspan regarding his "alarm" at the negative impact Sarbanes-Oxley have had on the US capital markets. Here is another take on the same subject from the Economist: ...the Intercontinental Exchange (ICE), a fast-growing, all-electronic operation based in Atlanta, which earlier this year began to compete against the tradition-bound New York Mercantile Exchange (NYMEX) in oil futures. [Charles Schumer, a Democratic senator from New York] is agitated about a perceived advantage for ICE that has broader implications for financial markets: the use of regulatory arbitrage. This is the idea that an exchange may operate in one jurisdiction rather than another so as to gain commercial advantage from more favourable regulation.

This strikes Mr Schumer as wrong, especially now that ICE has closed its trading floor in London and started to offer a contract in West Texas Intermediate crude oil, thus competing directly with NYMEX. James Newsome, president of NYMEX, says one regulatory difference that worries him is that ICE places no limit on the size of outstanding positions, while his exchange is subject to position limits under the CFTC. The New York exchange has responded by unveiling plans this month to list its energy contracts on the electronic trading platform of the Chicago Mercantile Exchange, in a deal intended to blunt ICE's technological edge.

ICE provides one example of how regulatory differences increasingly matter to exchanges. For another, take the (now suspended) bid by America's NASDAQ for the London Stock Exchange (LSE). The LSE has had success in attracting listings by overseas firms, often at NASDAQ's expense, in part owing to American laws such as the USA PATRIOT and Sarbanes-Oxley acts. Greater financial disclosure and the obligation for bosses to take responsibility for accurate reporting are two examples of rules that seem onerous to many...

At a time when hedge funds and other active investors are eager to move their money around the world and technology allows it to happen faster, regulators remain one of the last barriers to seamless global capital flows. Exchanges, meanwhile, are consolidating and accelerating their shift from floor to electronic trading, leaving them less tied to particular locations. “Exchanges aren't geographic concepts any more, they're legal concepts,” says Benn Steil, an exchange expert at the Council on Foreign Relations in New York.

What I found especially disturbing about this article was the reference to position limits as a competition dynamic. The implication is that, in an era of increased federal regulations, exchanges and exchange regulating bodies are feeling pressured into weakening the bulwarks of financial stability. As I see it, this, coupled with an alternative investment community that is constantly pushing the envelope in a quest for alpha, plus highly volatile markets for derivatives, is a very dangerous mix.

Saturday, April 22, 2006

Boston Leads in Hedge Funds - Not!!

No way!!

New federal findings may have put to rest the debate on which state is leading in the management of hedge funds. According to the findings, Massachusetts financial firms help manage more than $150 billion in hedge funds and other private investments. According to Securities and Exchange Commission estimates, this figure is about 10 percent of the $1.5 trillion held in private funds nationwide. Boston.com reports:

''Boston has historically been one of the largest players in the hedge-fund industry, because the city has a tremendous pool of talented managers in the financial-services sector," said Richard A. Goldman, coleader of the hedge fund practice group at law firm Bingham McCutchen.

This is complete and utter bunk! My former employer, a well known hedge fund in Westport Connecticut alone managed 150 billion.

Hey Boston...you sit on a throne of lies!!!

Thursday, April 20, 2006

StateMasterNationMaster, a great site for all sorts of statistics on countries, is now joined by StateMaster a database of statistics on the US States.

From Tyler Cowen:

From Tyler Cowen:Not all of neuro-economics uses brain scans. Andrew W. Lo, a professor at the Sloan School of Management at the Massachusetts Institute of Technology, applied polygraph-like techniques to securities traders to show that anxiety and fear affect market behavior. Measuring eye movements, which is easy and cheap, helps the researcher ascertain what is on a subject's mind. Other researchers have opened up monkey skulls to measure individual neurons; monkey neurons fire in proportion to the amount and probability of rewards. But do most economists care? Are phrases like "nucleus accumbens" — referring to a subcortical nucleus of the brain associated with reward — welcome in a profession caught up in interest rates and money supply? Skeptics question whether neuro-economics explains real-world phenomena...

The next step? Perhaps neuro-economics should turn its attention to political economy. Do people use the same part of their brains to vote as to trade? Is voting governed by fear, disgust or perhaps the desire to gain something new and exciting?

Doing experiments on monkeys to assess traders ability?...why wasn't I invited?

In this experiment, I think the test subjects and the experimental subjects are more positively correlated than is normal ;)

Foreign stocks are soaring and Americans are pouring money into them. But although overseas equities have captured investors' fancy before, there's a twist this time: More investors are embracing passive, index-style investing, ignoring the long-held belief that active managers can beat indexers by uncovering bargains in inefficient foreign markets.

More from Wharton:

"In February...investors poured nearly $19 billion into foreign-stock mutual funds, compared to $8.4 billion for U.S. stock funds....

...American investors have also grown enamored of indexers, which now hold about 15% of assets invested in foreign-stock funds, up from about 5% in 2001, according to AMG Data Services. 'People want diversification at the cheapest cost,' notes Wharton finance professor Jeremy Siegel, who talks about the latest economic developments in a podcast included in this issue......It probably will continue.

'Siegel says the typical American investor should have 40% of his or her equity portfolio in foreign stocks....you don't want to confine yourself to one country....I really advise broad diversification.'

40% seems a bit high, especially in today's foreign equity markets, but the point is valid non-the-less.

Friday, April 14, 2006

The Avuncular StateSometimes you vaguely sense a phenomenon so omnipresent that it appears to be nothing more than a series of coincidences. It is not until someone points it out that it truly takes form. What the bloody hell am I talking about you ask? Soft Paternalism my friend...let the Economist open your eyes, here, and here

Thursday, April 13, 2006

Greenspan predicts US governance revamp

I posted about this before.

In a global economy, it is imperative that capital market regulators take into account the ease with which capital can flow from one region to another. Sarbanes-Oxley is an perfect example of a lack of the global perspective by regulators. What started as a good idea in the wake of the Enron scandal, may prove to be extremely problematic for US investors.

Although the basis of the law was a definite advance in terms of governance, it is possible that some parts of Sarbanes-Oxley has created too many burdens for business; especially the provision that forces companies to have their internal controls certified by auditors.

Maestro...

From the Financial Times:

Alan Greenspan, former chairman of the US Federal Reserve, predicted yesterday the US would make "changes" to the burdensome financial and corporate governance requirements driving companies out of US markets.

Mr Greenspan initially supported the passage of the Sarbanes-Oxley law - the landmark 2002 legislation introduced after the Enron and WorldCom scandals - but said yesterday he was "disturbed" when companies started favouring London over New York for their flotations.

"The Sarbanes-Oxley Act has created significant problems for foreign investors with its regulatory structure," he said at a question and answer session at the Asian Financial Centres conference ..."I am nevertheless acutely aware and disturbed by the fact that initial public offerings have moved away from the US - and to a large extent have moved to London."

"My impression is that there will be changes," said Mr Greenspan. But in Washington it is far from clear what could be done about the law...

Also at the Asian Financial Centres conference with Mr. Greenspan was former New York mayor Rudy Giuliani, who said he thought that London and Tokyo would eventually adopt similarly tough regulations. A question I would pose is when and just how much damage to the US capital markets would be done in the interim.

Wednesday, April 12, 2006

Thorns in the Foliage

Here is a trend that I expect will accelerate:

Financial watchdogs are making life less comfortable for hedge funds

Life looks pretty good in hedge-fund country. The mansions are sprawling;

luxury-car dealerships—Mercedes, BMW, Maserati, Ferrari—sit cheek by jowl; and

there are lots of fancy shops and cafés with faux-French names. In Greenwich,

home to more than a few investment boutiques, even the local library oozes

money: rows of pricey Aeron chairs cushion the posteriors of well-dressed

patrons as they browse the internet on flat-screen monitors.Nevertheless, these days it is becoming harder for hedge-fund managers to

make money. Those who invest the wealth of rich individuals, family offices and

institutions using fiendishly complicated investment strategies face greater

competition. New funds are set up almost every day: across the world there are

now more than 8,000. More dollars are pursuing the same strategies, reducing

returns for many. The costs of both fund-management talent and office space are

climbing.Since February 1st, new rules have added a layer of cost and compliance for

many funds. The Securities and Exchange Commission (SEC) now requires most

hedge-fund managers to register if they have 15 American investors or more. The

idea is to keep a closer eye on those with lots of investors than on those with

a few rich ones, who are presumed to be better able to look after themselves.The industry's sheer size—it now manages more than $1.5 trillion, according

to HedgeFund Intelligence, a specialized information firm—has prompted

regulators around the world to take a much closer look. Recently, the financial

regulators in Dublin shut down three hedge funds operated by Broadstone Fund

Management, an investment firm. Meanwhile in Britain, where more than

three-quarters of Europe's hedge-fund assets are managed, the Financial Services

Authority (FSA) has been looking into potential conflicts of interest among fund

managers and the unfair treatment of investors.

This trend is here to stay. Yet it may have a silver lining for some Hedge Fund managers.

...However, not all the regulatory attention is unwelcome. The FSA has also said

that it may allow retail investors, not just institutions or rich individuals,

to invest in funds of hedge funds, which spread money across individual funds

using a single investment product.

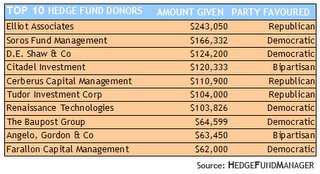

Call me cynical, but I wonder if the specter of looming regulations is in anyway correlated with political contribution by fund managers in the above graph...nahh!

More Here

Knowledge@Wharton:

Everyone uses commodities such as wheat, cocoa, crude oil, butter, coal and electricity. But most investors know that speculating on commodities in the futures markets is only for the pros, and no sensible amateur would bet his retirement or college funds on sugar, silver, orange juice or feeder cattle.But are commodities really that risky? A shortage of data has left that question unanswered. Until now. Using the most comprehensive data on commodities futures returns ever assembled, Wharton finance professor Gary Gorton and K. Geert Rouwenhorst, finance professor at the Yale School of Management, have reached a surprising conclusion: Commodities offer the same returns as investors are accustomed to receiving with stocks, which are typically viewed as safe enough for ordinary investors. "That was quite startling to many people around the world, both in academia and outside academia," Gorton said. "They thought it would be lower."Commodities are, in fact, not as risky as stocks, according to Gorton and Rouwenhorst, who recently completed a paper on this topic titled, "Facts and Fantasies about Commodity Futures." Most important, commodities are negatively correlated with stocks and bonds.

This is an interesting finding, but one that is not new to many people. An interesting question is if we will see a growth in instruments such as commodity ETF or mutual funds from research such as this, we should and I hope we do. The great majority of investors are missing out on greater diversification as the common wisdom is that commodities carry more risk than do equities.

Click here to read the whole story.

Thursday, April 06, 2006

Hiring the Next Generation of Quants

Here is a good article from FinanceTech regarding the acceleration of 'quant' hiring by Wall Street firms. Check out the following:

""As quantitative trading strategies continue to dominate the financial

markets, in addition to hiring for trading positions, Wall Street firms find

themselves in need of new skill sets. As a result, investment banks and hedge

funds are experimenting with different tactics to secure the next generation of

talent. Though all Wall Street firms recruit on the leading university campuses,

the high demand for quantitative skill sets is pushing more and more firms to

search for students in creative ways.

...While firms have leaned heavily on wooing talent from academic

institutions over the past 10 years, many are shifting their strategies. "As a

general rule, [Wall Street firms] go to academia, almost always an Ivy League

school with a Ph.D. in finance" to find talent, says one industry veteran who

has served as a senior technology executive at several leading hedge funds. But

finance majors don't always provide the answers. For example, firms may want to

hire a petroleum engineer - a true engineer - for energy trading, notes the

source, who requested anonymity.

Christiane Mandell, global head of foreign exchange for Bank of America,

says financial institutions are seeking graduates from the nation's 10 or 12

financial engineering programs, rather than tapping MBA/finance majors. She

relates that over the last few years, BofA has been hiring more people with math

and physics backgrounds than it had in the past... ""

For those who don't know, a quant is an investment professional that uses complicated mathematics to model financial markets.

I remember a talk I had with one of my finance professors last year. We were discussing UCONN's MSc program in Applied Financial Mathematics. He was convinced that an MSc in Finance was for "research only." I don't think he could have been more wrong. The trend towards quants is not only here to stay, but I think it will be growing exponentially.

My advice to anyone thinking of getting into the investment field, do your undergrad in a 'hard science,' and get a quantitative MSc. Forget an MBA, an MSc in Finance will take half the time and it's worth twice as much.

Here is a great list of finance MSc programs.