. : About me : .

Name::Trade Monkey

From::Middlebury, Connecticut, United States

Email Me!

View my profile

. : Recent Posts : .

Imports From China Aren't Pricier -- Yet

Further evidence that the Fed may be done tightening:

Google Finance Launches

Rising Wages in China

Punish Me Please!

Et Tu Francé?

That's Because They're a Pack of Pikers!

Discrepancy in USD/CAD Fundamentals

Normalizing Yield Curve?

Help With Copulas

. : Archives : .

February 2006

March 2006

April 2006

May 2006

June 2006

. : Tools : .

. : Fin/Econ Links : .

. : Misc Links : .

Atlas Shrugs

Belmont Club

Cato Institute

Foreign Dispatches

Instapundit

Kim Du Toit

MIT OpenCourseware

Oxblog

Protein Wisdom

Samizdata

Templates By Caz

TCS Daily

Truth on the Market

Volokh Conspiracy

**View my Wish List**

. : Credits : .

Template By Caz

Powered by: Blogger

Tuesday, March 21, 2006

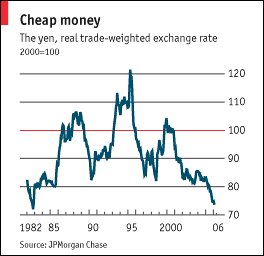

The Yen Also Rises

Is the fundamental imbalance between the USD/JPY about to end?

From the Economist:

...a deteriorating balance on investment income is also pushing up the current-account deficit. Despite its large net foreign liabilities America has until now earned a surplus on investment income because its foreign assets (largely direct and equity investment) earn a higher return than it pays on its liabilities, such as Treasury securities. But net investment income moved into deficit in the fourth quarter. Higher bond yields and lower foreign equity returns than in 2005 are likely to mean a deficit this year, for the first full year since records began in 1960.

Economic theory says that the current-account deficit can be no help to the dollar; and after rising for most of 2005, the greenback has slipped by around 3% against the yen and the euro since November. Last year the dollar was supported by rising American interest rates, but the European Central Bank and the Bank of Japan (BoJ) have now also both started to tighten policy.

The slide in the yen's real exchange rate seems odd, given that Japan boasts the world's largest current-account surplus ($164 billion last year). The explanation lies with Japan's loose monetary policy of recent years, which is now coming to an end. Last week the BoJ said it was ending its policy of “quantitative easing” (ie, printing tonnes of money). It is expected to start raising rates before the end of the year.