Name::Trade Monkey

From::Middlebury, Connecticut, United States

Email Me!

View my profile

Risk and Commodity Futures

Hiring the Next Generation of Quants

The Single Market is Near!!

The Yen Also Rises

Imports From China Aren't Pricier -- Yet

Further evidence that the Fed may be done tightening:

Google Finance Launches

Rising Wages in China

Punish Me Please!

Et Tu Francé?

February 2006

March 2006

April 2006

May 2006

June 2006

Atlas Shrugs

Belmont Club

Cato Institute

Foreign Dispatches

Instapundit

Kim Du Toit

MIT OpenCourseware

Oxblog

Protein Wisdom

Samizdata

Templates By Caz

TCS Daily

Truth on the Market

Volokh Conspiracy

**View my Wish List**

Template By Caz

Powered by: Blogger

Wednesday, April 12, 2006

Thorns in the Foliage

Here is a trend that I expect will accelerate:

Financial watchdogs are making life less comfortable for hedge funds

Life looks pretty good in hedge-fund country. The mansions are sprawling;

luxury-car dealerships—Mercedes, BMW, Maserati, Ferrari—sit cheek by jowl; and

there are lots of fancy shops and cafés with faux-French names. In Greenwich,

home to more than a few investment boutiques, even the local library oozes

money: rows of pricey Aeron chairs cushion the posteriors of well-dressed

patrons as they browse the internet on flat-screen monitors.Nevertheless, these days it is becoming harder for hedge-fund managers to

make money. Those who invest the wealth of rich individuals, family offices and

institutions using fiendishly complicated investment strategies face greater

competition. New funds are set up almost every day: across the world there are

now more than 8,000. More dollars are pursuing the same strategies, reducing

returns for many. The costs of both fund-management talent and office space are

climbing.Since February 1st, new rules have added a layer of cost and compliance for

many funds. The Securities and Exchange Commission (SEC) now requires most

hedge-fund managers to register if they have 15 American investors or more. The

idea is to keep a closer eye on those with lots of investors than on those with

a few rich ones, who are presumed to be better able to look after themselves.The industry's sheer size—it now manages more than $1.5 trillion, according

to HedgeFund Intelligence, a specialized information firm—has prompted

regulators around the world to take a much closer look. Recently, the financial

regulators in Dublin shut down three hedge funds operated by Broadstone Fund

Management, an investment firm. Meanwhile in Britain, where more than

three-quarters of Europe's hedge-fund assets are managed, the Financial Services

Authority (FSA) has been looking into potential conflicts of interest among fund

managers and the unfair treatment of investors.

This trend is here to stay. Yet it may have a silver lining for some Hedge Fund managers.

...However, not all the regulatory attention is unwelcome. The FSA has also said

that it may allow retail investors, not just institutions or rich individuals,

to invest in funds of hedge funds, which spread money across individual funds

using a single investment product.

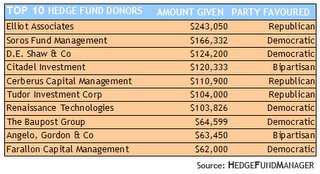

Call me cynical, but I wonder if the specter of looming regulations is in anyway correlated with political contribution by fund managers in the above graph...nahh!

More Here