Name::Trade Monkey

From::Middlebury, Connecticut, United States

Email Me!

View my profile

Can Managed Alpha Returns be Replicated?

Not With a Bang But a Whimper

The Trader is Dead, Long Live the Trader!

Want to be a Trade Monkey??

Fed Chief Wary of Regulating Hedge Funds

Lack of Posting

Headline of the Day

Power Law in FX Trading

How Not to Respond to High Gas Prices

VC Firms Bet on Clean Energy Deals

February 2006

March 2006

April 2006

May 2006

June 2006

Atlas Shrugs

Belmont Club

Cato Institute

Foreign Dispatches

Instapundit

Kim Du Toit

MIT OpenCourseware

Oxblog

Protein Wisdom

Samizdata

Templates By Caz

TCS Daily

Truth on the Market

Volokh Conspiracy

**View my Wish List**

Template By Caz

Powered by: Blogger

Saturday, March 25, 2006

The Single Market is Near!!

Wharton has a great piece on the looming merger of the NASDAQ-LSE and its meaning in the larger context of market consolidation.

Some notable points:

"There's an obvious advantage in centralizing exchanges," says Wharton finance professor Richard J. Herring. Bigger exchanges enjoy economies of scale that reduce trading costs. That attracts more traders and listing companies. And as trading volume increases, it's easier for buyers and sellers to find one another. The improved liquidity helps share prices respond more quickly and accurately to changes in supply and demand.

"Part of the reason this is happening is that there is a drive to have a single market in financial services," says Franklin Allen, professor of finance and economics at Wharton. "That's a big thing in Europe. At the moment, they have far too many exchanges. Clearing and settlement [bookkeeping to complete transactions] aren't nearly as smooth as they should be, and transaction costs are too high." Allen estimates there is a 60% to 70% chance the LSE will merge with Nasdaq....

Of particular note is the role that (excessive?) regulation has played in the drive toward market consolidation:

The Sarbanes-Oxley law enacted in the wake of the Enron scandal, for example, requires expensive new auditing procedures and makes chief executives and chief financial officers legally liable for the accuracy of their firms' financial statements. "The Sarbanes-Oxley requirement has made it pretty unattractive for companies who haven't already listed here to choose the U.S.," Herring says.

In addition, Blume notes, many institutional traders are unhappy with the so-called "trade-through" rule in the U.S. "It causes an integration of all the markets and that's a very expensive thing to do, and institutions don't like it." The rule involves a National Market System (NMS) that links exchanges around the country so that traders get the best prices available anywhere. A buyer placing an order through the NYSE might, for example, be matched with a seller on the Nasdaq or Philadelphia exchange if that seller offered a lower price than anyone on the NYSE.

Tuesday, March 21, 2006

The Yen Also Rises

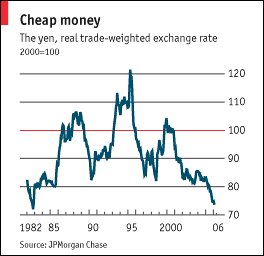

Is the fundamental imbalance between the USD/JPY about to end?

From the Economist:

...a deteriorating balance on investment income is also pushing up the current-account deficit. Despite its large net foreign liabilities America has until now earned a surplus on investment income because its foreign assets (largely direct and equity investment) earn a higher return than it pays on its liabilities, such as Treasury securities. But net investment income moved into deficit in the fourth quarter. Higher bond yields and lower foreign equity returns than in 2005 are likely to mean a deficit this year, for the first full year since records began in 1960.

Economic theory says that the current-account deficit can be no help to the dollar; and after rising for most of 2005, the greenback has slipped by around 3% against the yen and the euro since November. Last year the dollar was supported by rising American interest rates, but the European Central Bank and the Bank of Japan (BoJ) have now also both started to tighten policy.

The slide in the yen's real exchange rate seems odd, given that Japan boasts the world's largest current-account surplus ($164 billion last year). The explanation lies with Japan's loose monetary policy of recent years, which is now coming to an end. Last week the BoJ said it was ending its policy of “quantitative easing” (ie, printing tonnes of money). It is expected to start raising rates before the end of the year.

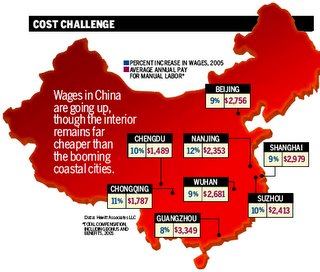

If the wages of U.S. workers were rising at 10% per year, you can be sure economists would be sounding the inflation alarm bells. After all, even the slightest sign of an upward surge in labor costs brings calls for the Federal Reserve to boost interest rates even faster.

But what if it's Chinese wages that are rising at a 10% pace? Should the Fed care? In the era of globalization it sometimes feels as if Guangdong and China's other industrialized provinces are extensions of the U.S economy. Indeed, the value of cheap imports from China -- about $240 billion in 2005 -- exceeds the net revenues of the U.S. securities industry. With that large an impact, it wouldn't be a surprise if soaring wages in China translated to higher import prices and faster inflation in the U.S.

But here's the surprise: For now the cost increases in China are not being passed through to U.S. prices. The latest data from the Bureau of Labor Statistics, released on Mar. 15, show that the price of imports from China has fallen by 0.4% over the past year, vs. a 1.8% rise in the price of non-oil imports from all countries. In part, rapid productivity jumps in Chinese manufacturing may be allowing employers to pay higher wages and still keep prices low.

WASHINGTON (AFX) -- U.S. wholesale prices plunged 1.4% in February, the biggest decline in nearly three years, the Labor Department reported TuesdayEnergy prices fell 4.7%, also the biggest drop since April 2003. Food prices fell 2.7%, the most in four yearsEconomists expected the PPI to fall about 0.3%The core producer price index - which excludes food and energy prices - rose 0.3%, stronger than the 0.1% gain expected by Wall Street economists surveyed by MarketWatch. In the past year, the PPI has risen 3.7%, compared with 5.7% last month.

The Feds reaction?

The report is not likely to have much impact on the Federal Reserve's deliberations next Tuesday. Most analysts expect the Federal Open Market Committee to raise overnight lending rates for the 15th straight meeting to stay ahead of inflationary pressures. Last week, the Labor Department reported that consumer prices were well behaved in February...

Read the whole thing.

After much speculation, Google this morning launched Google Finance. Google Finance differs from Yahoo Finance in three crucial respects: first, it attempts to present most information about a stock on a single page. Second, it leverages the breadth of external sources from Google News. Third, in contrast to Yahoo which is investing in its own content (particularly in personal finance), Google Finance is built entirely of licensensed data and links to external sources.

More here:

Sunday, March 19, 2006

Rising Wages in China

A labour shortage is driving up wages in China by about 10% a year, reports Business Week in a new article, How Rising Wages Are Changing The Game In China:

Wait a minute. Doesn't China have an inexhaustible supply of cheap labor? Not any longer. From the textile and toy factories of the south to the corporate headquarters and research labs in Beijing and Shanghai, the No. 1 challenge today is finding and keeping good workers. Turnover in some low-tech industries approaches 50%, according to the Institute of Contemporary Observation, a Shenzhen labor research group.

Guangdong Province says it has 2.5 million jobs that remain unfilled, while Jiangsu, Zhejiang, and Shandong provinces say they, too, face shortages of qualified workers. "Before, people talked about China's unlimited labor supply," says Zhang Juwei, deputy director of the Institute of Population & Labor Economics at the Chinese Academy of Social Sciences in Beijing. "We should revise that: China is facing a limited supply of labor."

Reports of labor shortages first cropped up in late 2004, but companies thought the phenomenon was temporary. Now a surge in both turnover and wage costs is convincing multinationals and their suppliers that the China game is changing permanently. With the gap between wages in China and those elsewhere gradually closing, the pressure to pass price increases on to consumers in the U.S. and other markets will start to build.

As Citigroup noted in a February report: "The continuous growth of labor costs in China, even at a moderate pace...is likely to have implications for inflation worldwide." These factors eventually will force the Chinese to upgrade their entire industrial base to make higher-margin goods. And those bigger paychecks are building a consumer class in China that multinationals want to target.

Apparently, the laws of supply and demand operate even in China.

This is good news for American as well as Chinese workers. Rising wages in China, coupled with China's new found enthusiasm for a more market-based exchange rate mechanism, will reduce competitive pressures American companies feel from Chinese imports.

I expect India, with it's highly segmented knowledge industry, to experience even more tightening of the domestic labor market.

Saturday, March 18, 2006

Punish Me Please!Is it me, or are the French the only people who will riot for more state control?

Morgan Stanley's Stephen Roach has some interest thoughts on the current state of globalization.

I found this to be especially interesting:

"Economics and politics are on a dangerous collision course. As the forces of globalization strengthen, the drumbeat of protectionism is growing louder. Made in France, the European strain of protectionism reflects a newfound nationalism that strikes at the heart of pan-regional integration. Made in America and exacerbated by fear of the “China factor,” a different strain of protectionism plays to the angst of middle-class US wage earners. Whether the threat is perceived to be from the inside (Europe) or the outside (the United States), the responses of increasingly populist politicians are worrisome, to say the least. French Prime Minister Dominique de Villepin is seeking to protect “strategic” industries from foreign ownership. In the US, it’s not just resistance to foreign takeovers, with bipartisan support building in the Senate to impose steep tariffs on China. All this harkens back to the demise of an earlier globalization that many date by the enactment of the infamous Smoot-Hawley Tariff Act of 1930 — a political blunder that may well have been key in turning a US stock market crash and recession into worldwide depression. Like the circumstances over 75 years ago, the current global trade dynamic has played an increasingly important role in boosting the world economy. Protectionism and the contraction in global trade it would trigger puts all that at risk."

Although Mr. Roach's comparison of the current wave of populist, bipartisan, protectionism to the 1930's is in my opinion, flawed. Yet I can't help but to agree that what we are witnessing is a pattern of populism that will have historic implications in Europe.

I'm not so worried about the American kind because:

a) I've seen worse.

b) Culturally, Americans are much more keen on competition than is Europe - Smoot-Hawley not withstanding.

Messer. de Villepin actions as of late are profound and disturbing to the concept of a European Union, yet it is hardly getting noticed on this side of the pond.

Thursday, March 16, 2006

That's Because They're a Pack of Pikers!Riz at ABOB Capital makes the following observation:

This may of interest to day traders. I've noticed that when a currency appears to be making some kind of obvious pattern, the announcement of economic data often can create a great deal of volatility but then, quite often, the spot rate settles back into completing the original pattern. Today's price action in EUR/USD is a perfect illustration. Before 13:30 (time of current account and retail data), EUR/USD appeared to be appreciating in a kind of horse-shoe pattern. The data created some volatility but after about half an hour, the pattern was firmly back on track. Is this an example of a pocket of predictability in an otherwise unpredictable market. It could be tested for with the right data set.

Here's the deal. The interbank brokers know on which side of the market the volatility lies, re: the "obvious pattern" Riz mentions.

Before key numbers, bid/offers widen. This widening gives the brokers a great opportunity to fade the quote. This, in turn, creates a minor trend. It's not a "pocket of predictability"; rather, it's the confluence of opportunity and unscrupulousness.

So saith Seth:

Earlier today housetaker quoted MakoML's analysis of major pairs. in his analysis of USD/CAD, MakoML notes that he thinks it will sell off because of the rising price of oil. it will be intersting to see what happens tomorrow, assuming that the bank of canada raises rates.

I've also heard technical justification for this trade.

Wednesday, March 15, 2006

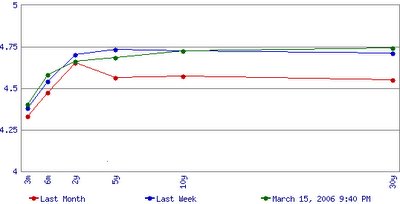

Normalizing Yield Curve?

I was reading a paper by Harry M. Kat & Helder P. Palaro, (I know, I need to get a life.) In it, they talk about replicating Hedge Fund returns using a mathematical tool known as 'copulas.'

Can anybody explain copulas to me - or at least refer me to a source where I could learn more about them. All the information I found is sketchy and sometimes contradictory.

Thanks.

From Reuters:

ATLANTA, March 15 (Reuters) - The Federal Reserve has raised U.S. interest rates to a level at which it is hard to predict where borrowing costs will go from here, a top Fed official said on Wednesday.

"It was a lot easier for the last 20 months to know which way we were going and even the pace at which we were going," Guynn said in answer to a question after speaking at an exhibit opening. "I think we're about at a point now, I say about, a point where there are uncertainties on both sides."

"I really think we're at a point ... (of) not being able to say exactly what's around the next corner... as opposed to being able to say exactly what the next couple of steps on policy might be," he added.

The major indices close to all time highs, oil inventories up and gas prices at near-term lows, low unemployment with looming wage pressures coupled with a increasingly wary housing market and waning foreign demand means that the fed may signal that they are done raising rates, for now, and indeed they may be. What will the markets make of all this...?

Bullish run into the summer!

Tuesday, March 14, 2006

Updates to SiteJust made some updates to Trade Monkey... any thoughts?

Saturday, March 11, 2006

Building a Better Wall Street?Just finished reading a good article on disruptive technologies and it got me thinking...what will the Wall Street of the future look like?

Few could argue that technology has already transformed the investment world, but what will be the driver going forward? My argument is that the future of financial innovation is more a function of mathematics and theory, not technology. Here is how I envision the future:

- Traders will execute trades generated by research signals and be non-discretionary: This will eliminate the potential for 'rouge traders.'

- Research departments at investment firms will have 'hubs' at major universities that work with the in-house researchers: This will allow for much better allocation of intellectual resources within the financial community.

- Researchers will focus on creating algorithms that automate asset allocation decisions: This will go a long way towards eliminating 'human error' and allow researchers to leverage talent to create even more algorithms, etc, etc.

- The returns of hedge funds will be replicated and create a market for 'alternative investment indexing': This will greatly reduce the fees that hedge fund managers can charge and create a wave of consolidation within the alternative investment management industry.

Monday, March 06, 2006

Libertarian's LamentThere is a well-entrenched way of thinking prevalent in American society, that for lack of a better phrase, I shall dub 'The Religion of Structural Efficacy" - (I know, it's bad, but it's only the first draft!)

Don Boudreaux comments nicely on the phenomenon at Cafe Hayek:

...Things people do individually -- for their own purposes, using their own gumption, own wits, and own resources, neither incited by nor directed by government -- too often are not counted as things that "we" do. The assumption seems to be that unless certain things are done by government, they aren't done -- even if they are done!

Consider this comment appearing originally on Brad DeLong's blog. (It's an outstanding site, by the way.) I first encountered this comment in this Business Week Online article by Michael Mandel:

"I'm not an economist, but it seems to me that one problem with Mandel's argument is that we're not investing in human capital. Government spending on universities has been slashed, leading to huge increases in tuition and much greater burdens on individuals and families." --Rebecca Allen, commenting on delong.typepad.com

"We're not investing in human capital" laments Ms. Allen -- who then immediately says that tuition is rising and that "individuals and families" apparently are paying this higher tuition despite the fact that doing so is a great burden. So, individuals and families are investing in human capital. But in Ms. Allen's view, we're not investing.

Why not?

Good question...

Thursday, March 02, 2006

Good morning!

Sorry about not posting yesterday but I've been busy, what with the job search and all.

Earlier this week I solicited ideas for Trade Monkey. Some suggestions include:

- A real-time price-data ticker.

- A section that provides stock tips.

- Another section on translating financial jargon into English; such as "what is a Hedge Fund?"

- Fewer statistics jokes.

I'm looking into the ticker. And since I'm more of a futures and currencies guy - all my equity exposure is indexed - I'm refraining from stock tips. I'm bid on 3 and will try one or two more stat jokes...sorry.

Trade Monkey is a work in progress and I have no idea what it should look like. As I make changes please comment so I know what tastes the readers of Trade Monkey have. I will do my best to implement suggestions.

Please send suggestions and comments to: trademonkey@adelphia.net